|

| News | |

24 July 2013 - Automotive aftermarket - robust and growing

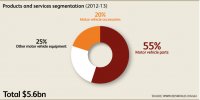

The 2013 industry survey report completed last month by the Australian Automotive Aftermarket Association (AAAA) revealed an optimistic industry with 76% of respondents expecting their businesses to grow. AAAA Executive Director Stuart Charity said the upbeat survey response reflected the continued growth of the automotive aftermarket sector. "All available information indicated aftermarket sector growth averaging 3.5% per annum over the last two years. This was consistent across the three main aftermarket segments - manufacturing, product reselling and service and repair - and fuelled respondents' optimism," he said. "While Australia set a new record for vehicle sales in 2012 of 1.112 million, only 12.5% of them were locally produced. Vehicle manufacturing is now valued at $13.38 billion representing only 12.3% of the total $108.8 billion Australian automotive industry. "With vehicle makers and their component suppliers doing it tough in Australia, the aftermarket presents a positive picture. The switch to imported vehicles is one part of a changing automotive industry landscape. This trend creates new opportunities for the independent aftermarket and it creates some challenges. "Booming vehicle sales mean growth for our industry, even if independent aftermarket businesses wait up to four and a half years before they see these customers in their stores and workshops.” said Stuart Charity. Scope of the aftermarket Australia's car parc of 16.7 million vehicles has an average vehicle age of 10 years. “It is estimated that some 9.2 million of these vehicles are serviced and repaired by about 13,000 independent aftermarket businesses performing service and repair work. There are also about 5,500 businesses that have a specialist focus, such as brakes, cooling and suspension,” he said. “The estimated 3,500 dealership workshops service about 7.5 million vehicles. “Aftermarket sales of parts and accessories are estimated to be $5.6 billion a year from about 1,758 resellers. About 19% of them have a turnover of less than one million dollars and 70% turnover between one and five million dollars. "While most outsiders perceive the aftermarket as only workshops and spare parts stores, the industry is actually broadly based. It encompasses mechanical repair and modification services, manufacturing and re-manufacturing, importing, wholesale, distribution and retail sales for all vehicle parts, accessories, tools, equipment and services, except those products used in the manufacturing of original equipment. It does not include the $5.6 billion body repair industry," said Stuart Charity. Commissioned by the AAAA to identify trends and influences that will affect Australian automotive aftermarket businesses in the short and medium terms, the study revealed that advancing technology and globalisation are changing aftermarket business models. Private vehicles carry a large part of the transport burden in Australia for work and play. According to the Australian Bureau of Statistics, private vehicles transport 65.8% of Australians to work. Only 10.4% of employed people use public transport to get to work, with the balance using other methods or working at home. "Supplying parts, servicing and repairing Australia's private fleet mean more than sorting the family car for the annual holiday. It is the critical strategic task of keeping the nation mobile and is embedded in the structure of our society and economy," said Stuart Charity. Industry snapshot The major trends identified in the AAAA survey report include: The product categories that retailers are predicting for growth over the coming years include 4WD and camping, accessories, electrical, brakes, suspension and steering. The top five product segments forecast to have the greatest decline include engine, exhaust, audio and communication, body and trim and performance parts and accessories. Moving the aftermarket forward Survey respondents said major challenges confronting the industry included keeping pace with the rapid advances in vehicle technology and access to necessary information, tools and equipment. Future opportunities identified were Australia’s proximity to Asian growth markets, the ability to achieve productivity gains through new systems, processes and technology, the forecast growth in the economy, car parc and consumer spending, and leveraging multi-channel routes to market. Australia’s strong aftermarket manufacturing segment has an international reputation for high quality product in niche market segments. Given the rapid decline in Australian new car production, a significant part of the estimated $5.4 billion parts manufacturing segment in Australia would be aftermarket production, although it is difficult to determine exact figures. Respondents reported more than 60% of production and 70% of research and development are completed in Australia. Some 77% of aftermarket manufacturers believe their businesses will be more profitable over the coming three years. This is in spite of the high Australian dollar, labour and material costs. The major manufacturing product categories are performance parts and 4WD accessories followed by steering and suspension. These products are also strongly represented in Australian exports, which are now estimated at more than $800 million a year. Vision from industry – and Government “In spite of its strength, contribution to the community and future prospects, the manufacturing sector of the Australian automotive aftermarket is often overlooked by policy makers. Establishing a level playing field for the Australian automotive aftermarket sector in a global market is a major challenge,” said Stuart Charity. “For example, less than 12% of local manufacturers had access to any Federal Government support last year. Many respondents said Government must support exports and ensure copyright laws are effective and actively enforced. Others stated that input costs and employment laws put pressure on business viability, forcing the industry to consider greater off shore production. "The 2013 AAAA survey revealed an optimistic and energetic automotive aftermarket. This sector succeeds because it continues to provide consumers with the quality goods and services they want. Moving the aftermarket forward demands increased productivity and new business models from the industry - as well as vision from Government,” said Stuart Charity.

|